does idaho have capital gains tax

208 334-7660 or 800 972-7660 Fax. Does idaho have capital gains tax on real estate Monday July 25 2022 Edit Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021.

Historical Idaho Tax Policy Information Ballotpedia

Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

. Box 36 Boise ID 83722-0410 Phone. Capital Gains Tax Calculator 2022. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below.

Idahos tax system ranks 17th overall on our 2022 State Business Tax Climate Index. Your income and filing status make your capital gains tax rate on real estate 15. Object Moved This document may be found here.

Wages salaries 100000 Capital gains - losses -50000. Section 63-105 Idaho Code Powers and Duties - General Income Tax. Use Form CG to compute an individuals Idaho capital gains deduction.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. Does Idaho have an Inheritance Tax or an Estate Tax.

The land in Idaho originally cost 550000. Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Capital gains are taxed as ordinary income in Idaho.

208 334-7846 taxrep. 500000 for married couple - will not. Above that income level the rate jumps to 20 percent.

State Tax Commission PO. State Tax Commission PO. The percentage is between 16 and 78 depending on the actual capital gain.

Subscribe to receive email or SMStext notifications about the Capital Gains tax. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property. Each states tax code is a multifaceted system with many moving parts and Idaho is no exception.

There is a Federal Capital Gains Tax in Idaho which is also imposed in the other 49 states. However theyll pay 15 percent on capital gains if their income is 40401 to 445850. The Idaho Income Tax.

Capital Gains Taxes. The District of Columbia moved in the. The capital gains rate for Idaho is.

This basically states that any profits you make from selling precious metals will incur a tax of as much as 28 with the actual amount depending on your location and income. HB 449 would eliminate the state capital gains tax on the sale of precious metals. 500000 for married couple - will not be taxable.

Idahos maximum marginal income tax rate is the 1st. Capital gains tax is the tax that you pay on those capital gains. Idaho does not levy an inheritance tax or an estate tax.

Precious metals in bullion form are a constitutional form of money and should be treated as such when it comes to taxation. Because this is a farm it is impossible forme to figure the actual exact tax rate for this sale. Capital gains for farms is.

The Federal Capital Gains Tax applies to all precious metals. The capital gains rate for Idaho is. Idaho doesnt have an estate or inheritance tax for.

208 334-7660 or 800 972-7660 Fax. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more information on this rule.

Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. Idaho has a 600 percent state sales tax rate a 300 percent max local sales tax rate and an average combined state and local sales tax rate of 602 percent. Does Idaho have an Inheritance Tax or an Estate Tax.

However the state does not charge this capital gains tax on the sale of traditional currency no matter how much it might have inflated.

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Capital Gains Tax Idaho Can You Avoid It Selling A Home

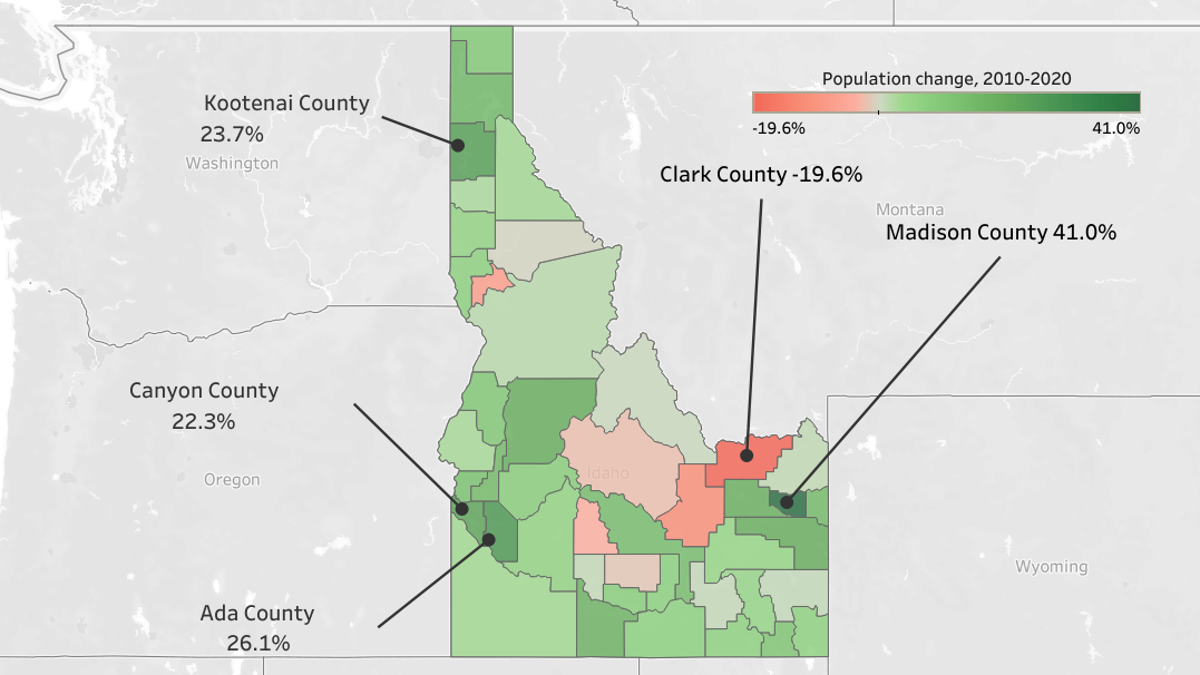

Idaho Remains Fastest Growing State Utah Second News Tetonvalleynews Net

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Idaho State 2022 Taxes Forbes Advisor

Top 4 Renovations For The Greatest Return On Investment Infographic Infographic Investing Renovations

Mapsontheweb Kansas Missouri Los Angeles North Washington

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Guide To Combined Reporting Idaho State Tax Commission

Greater Idaho May Expand To The Ocean As 3 Oregon Counties Vote In May R Idaho

Idaho 529 Plan And College Savings Options Ideal College Savings Plan

How To Start A Real Estate Business Infographic

Where Upper Middle Class People Are Moving Upper Middle Class Middle Class Financial Advice

Idaho Income Tax Calculator Smartasset

The Ultimate Guide To Idaho Real Estate Taxes

Capital Gains Tax Estimator East Idaho Wealth Management